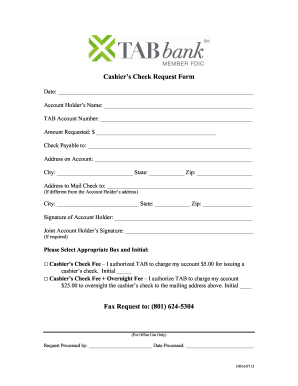

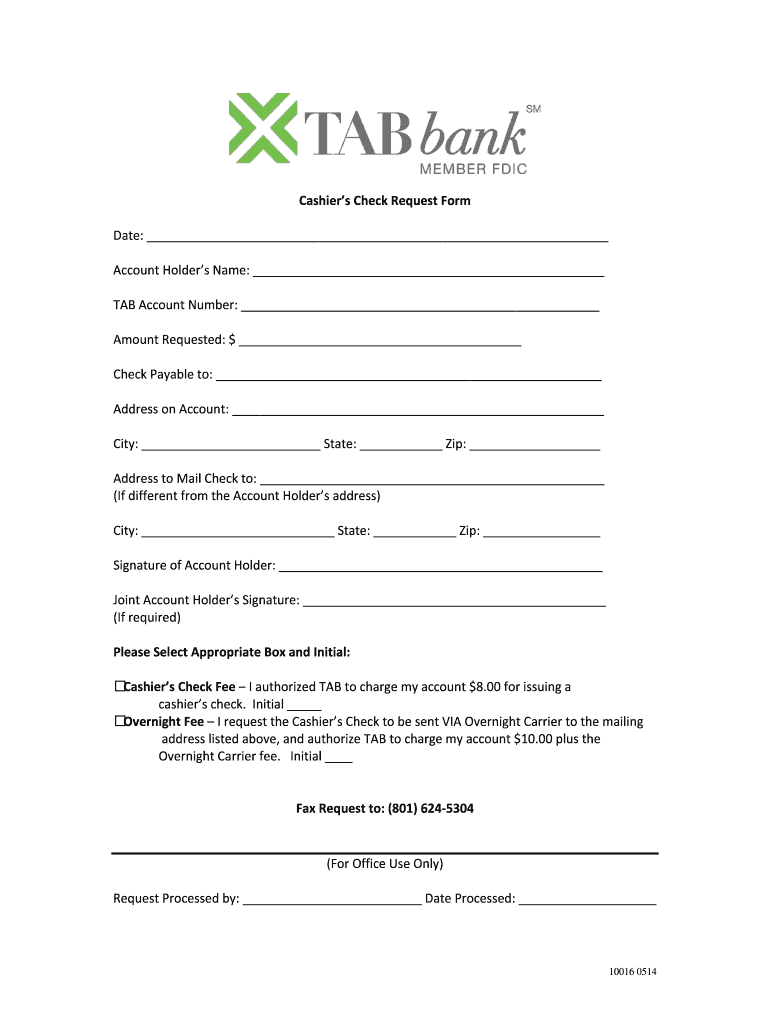

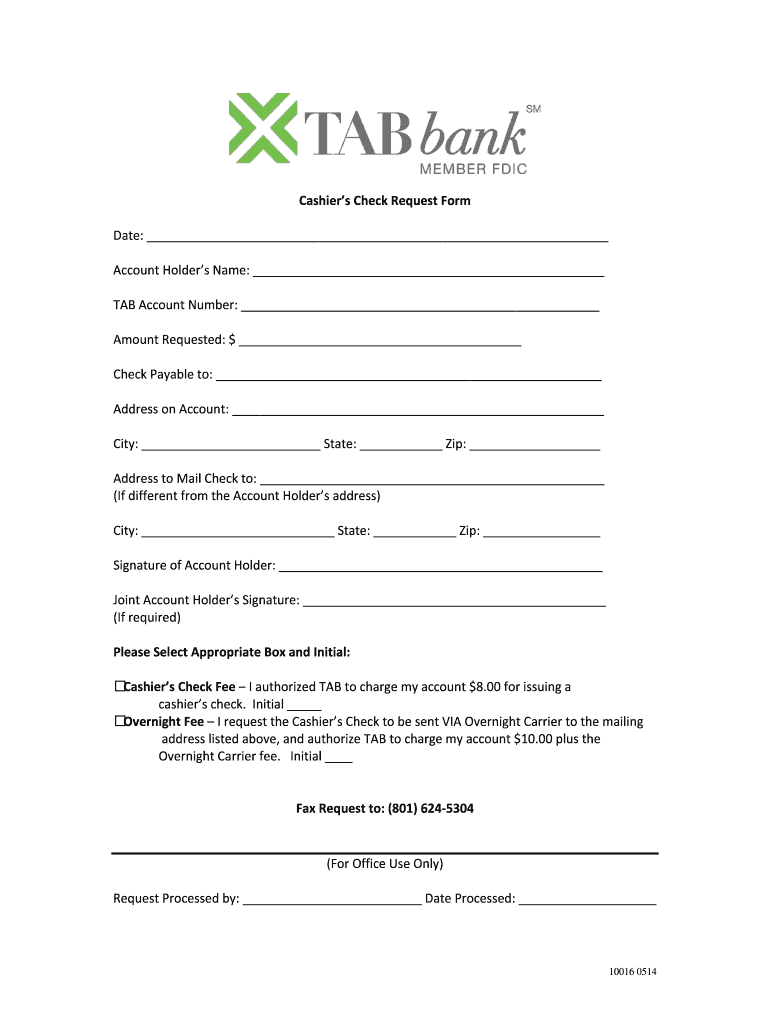

TAB Bank Cashier's Check Request 2014-2026 free printable template

Show details

Cashiers Check Request This form may be used for any Principal Bank Cashiers Check request. Requests can also be processed by calling a personal banker at 1.800.672.3343. Please complete all the information

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign cashiers check template form

Edit your make a cashier check online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fillable cashiers check get form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit blank check template online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cashier cheque form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TAB Bank Cashier's Check Request Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out editable blank check templates form

How to fill out TAB Bank Cashier's Check Request

01

Begin by downloading or printing the TAB Bank Cashier's Check Request form.

02

Fill in your personal details, including your name, address, and contact information.

03

Specify the amount for the cashier’s check in the appropriate field.

04

Provide the name of the payee or the person/business to whom the check will be made out.

05

Include any relevant details or notes, if applicable, in the designated section.

06

Sign the form where required to authorize the request.

07

Submit the completed form to TAB Bank, either in person or via their required submission method.

Who needs TAB Bank Cashier's Check Request?

01

Individuals who need to make a secure payment.

02

Businesses requiring verified payments for services or goods.

03

Customers who prefer using a check rather than cash or electronic methods.

Fill

check template

: Try Risk Free

People Also Ask about printable cashier checks blank

Can I get a cashier's check without going to the bank?

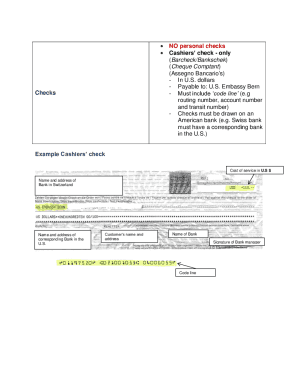

There are three main places where you can get a cashier's check: a bank, a credit union, and online. Most (but not all) banks and credit unions only issue cashier's checks to their own customers.

What's the easiest way to get a cashier's check?

You can get cashier's checks at banks and credit unions, usually one where you already have an account. It's good to be prepared with your identification, double-checked information for the person or business you're paying, and the amount of the check. You'll likely pay a fee.

How do you get a cashier's check?

You can get a cashier's check by visiting your bank branch or credit union or going to its website if it offers these checks online. If you don't want to use a cashier's check, other options include a money order, certified check, wire transfer, or social payment app.

Do you have to fill out a form for a cashier's check?

At most banks, any teller can fill out a cashier's check for you. At some banks, and depending on the amount of the check, you might need to talk to a customer service representative. You may need to fill out a form for your cashier's check.

Can I get a cashier's check from any bank?

You can walk into any bank or credit union and ask for a cashier's check. However, some institutions only issue checks for customers, so you may have to try several different locations (or open an account).

Can I write my own cashiers check?

Unlike a money order, on a cashier's check you can't write in the payee information yourself. It may be useful to take the payee to the bank with you, so that you have all the information you need. On the check itself, be sure to give the first and last name of the payee as it appears on their identification.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find online fillable blank checks?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the printable cashier's checks in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for the cashier check template pdf in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your cashier check template and you'll be done in minutes.

How do I edit printable blank cashiers check on an Android device?

You can make any changes to PDF files, like cashiers check template utilities, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is TAB Bank Cashier's Check Request?

TAB Bank Cashier's Check Request is a formal request to obtain a cashier's check from TAB Bank, which is a secure and guaranteed method of payment.

Who is required to file TAB Bank Cashier's Check Request?

Any customer or account holder who needs to obtain a cashier's check from TAB Bank must fill out the Cashier's Check Request.

How to fill out TAB Bank Cashier's Check Request?

To fill out the TAB Bank Cashier's Check Request, individuals must provide their personal information, the amount of the check, the payee's information, and any additional instructions as required by the bank.

What is the purpose of TAB Bank Cashier's Check Request?

The purpose of the TAB Bank Cashier's Check Request is to ensure that a cashier's check is issued for specific transactions that require secure funds and to provide a record of the request.

What information must be reported on TAB Bank Cashier's Check Request?

The information that must be reported on the TAB Bank Cashier's Check Request includes the requestor's name, account number, amount of the check, payee's name, and any special instructions or additional details.

Fill out your TAB Bank Cashiers Check Request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Printable Cashier Checks Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to fill in cashier check

Related to printable cashier s check form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.